In this post I’m going to review a book which is called How To Make Money, And How To Keep It, together with my own commentary and extra advice.

It’s a very old book (1867) which was written by Thomas A. Davies who was a millionaire involved in property business. Although this book was written such a long time ago, it shares wealth-building principles that apply to this very day.

Wealth principles never change

Wealth principles never change. Times change, tools change, technology is invented, but the principles of money-making always remain the same. So if you’re reading a book written by a millionaire that lived 100 years ago or someone who is alive today, the deepest concepts on wealth building will be identical.

If you internalize such wealth-building advice, you will always have money whether the economy is up or down. Whilst those who are deficient in this knowledge, though they may display stuff when the economy is going well, they will be stripped bare when it crashes.

What wealth really is

Listen to “Wealth Principles as Explained by a Millionaire” on Spreaker.

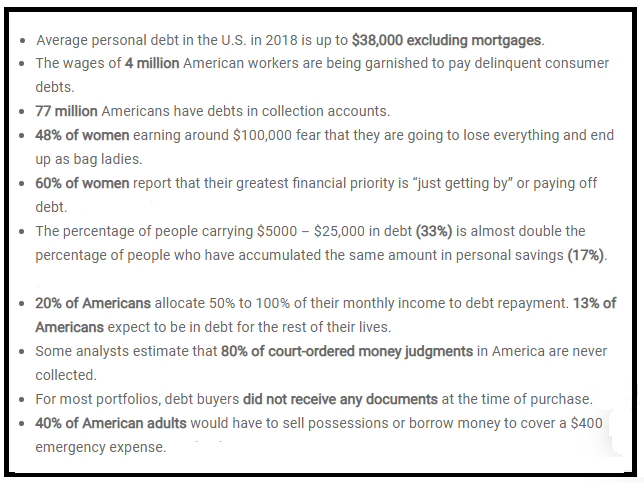

Wealth is not about beautiful houses and expensive clothes. If you’re in debt for these things, if you have to work all the time to afford them, actually you’re poor. The book says not to buy anything that you can’t afford, and just think about what the society would look like if people would listen to this advice…

People would look much poorer would they live a debt-free life. But that’s good because they would not deceive themselves and others with the external display.

Being debt-free is what gives you independence. Wealth is not about displaying stuff gotten on loan but about being free from debt. That’s what the author explains – the farmer owning his land without any debt is rich. He can live from it, he can live on it and he owes no one. That is true wealth.

The mindset of the masses is poverty mindset

The author explains that a poor person displaying stuff may fool those who are poor as well; but for those who are truly wealthy he will look like an ostrich hiding his head in sand yet the ugly body is for all to see.

Such people externally try to paint a picture of wealth, but there’s no change in the mind, so the wealth is not real. As I said, if economy crashes such a person is doomed. He never had real wealth, just a display of it.

The mind is not changed, behavior is not changed, so he’s still a poor person. And I find that poor people always like to show off the stuff whilst the rich often don’t do that. I mean sure, they wear expensive clothes; but poor people always try to show off things that have designer logos on them and things that scream luxury.

We can see that in Dubai. Most people in UAE were poor, but when oil was discovered in 1966, the residents who had little suddenly found themselves rich. And that really shows.

I find that almost any person whose background was poor will begin displaying stuff if he earns more money. But it’s best to focus on making the mind wealth-attracting rather than displaying expensive things. Because if the trend of wealth turns away from a particular locality, such people with unchanged minds will again have nothing.

Make money earn money

It’s so inefficient to work hard to earn money and then buy things that are “doodads”, which is a Robert Kiyosaki’s term for things that don’t make money.

It’s smarter to make money, save it and then put that money to work for you so that it generates passive income. People who get truly rich always save a part of their income in order for it to generate additional passive income.

When the person is not yet rich but is working towards it, the author advises to spend only on necessities and to save the rest. And most people would be able to save around 30% of their income if they cut all the unnecessary expenditures, like daily lattes or television program subscriptions.

Stop all money leaks

The author advises not only to maximize your earnings (I will share his tips further down in this review), but also to make sure there are no money leaks. He advises to mercilessly cut off anything that’s not absolutely essential if you’re not yet rich.

And this is the very advice of the current millionaire Gary Vee – he advises to live as though no one is watching you, and he says that if you’re not willing to eat inexpensive food and live in a cheap place whilst you’re building your business organically, you will probably not make it.

Self-worth issues behind the rich display

Most people can’t become truly wealthy because they have deep self-worth issues. That’s the reason they must have that latest iPhone or anything else. They want to be seen as worthy by the society. So firstly this issue must be addressed and solved, and only then can the author’s wealth advice be applied.

External appearance is not the sign of true wealth

Just visualize how you would feel living in a cheap apartment, wearing inexpensive clothes and driving an old car. If you would feel bad, then you need to look into self-worth issues.

The millionaire that I know in London who is in the real estate business and stocks wears the same inexpensive clothes all the time and he really looks poor. Yet he’s a millionaire. He absolutely doesn’t care what people think of him. This is so attractive, there are so few truly self-assured people.

The guy that I’m listening to on YouTube (I may interview him if he agrees, so for a bigger surprise I’ll keep his name secret for now), is a stock trader in New York living the best life, yet his phone is 6 years old. He says it works just fine, so why to waste money on buying a new one. He looks like everyone else. He doesn’t need to use his wealth to buy flashy things because he’s secure about himself.

I know another millionaire in London who owns a famous dance school. When she’s not working, she looks just like everyone else. She doesn’t want to stand out in any way.

The need to draw attention of others

I find that people who try to draw attention to themselves all the time do so from a place of insecurity – they are not sure of themselves so they need a confirmation of their worth through public applause. And this also applies to people who make a lot of money. If you’re secure about yourself, you will feel absolutely no need to impress others with the stuff that you own.

I have to add here that sometimes a position one occupies in the society requires a certain standard of living. But most people who feel compelled to display their wealth do so not because of the need to adhere to unwritten rules of their social status but because they’re insecure about their self-worth.

Wealth-building habits assure financial independence

The author explains that for true wealth mindset to be developed you must form wealth-building habits no matter how much or little you earn. Eventually this will lead to financial independence.

Such a wealth-building habit is spending only on essentials and then saving the rest for it to eventually be used as a passive-income builder. At the author’s time the safest investment was putting money into savings accounts.

I was amazed to read about what interest rates were present then – even up to 7%. For most of the world today the best investment would no longer be savings accounts but buying property, in my opinion.

So at first the person will put money into the savings account and still get some return for it (though not much), and then the lump sum should be used for property purchase.

That property should be, of course, purchased at a good price, refurbished if necessary, and rented out. All this can be handled by estate agents, who will take a percentage but then you don’t need to do anything. You just get monthly passive income.

So this is the way to wealth, according to the author. And it’s important to research what makes most and safest money in your country, because this could differ. Maybe you are from a few lucky ones who can get great interest from a bank and you don’t need to research anything about property business at all (unless you’re interested in that, of course).

Get-rich quick schemes lead to poverty

The author explains that when it comes to putting money to work, the greatest mistake people make is investing in risky ventures. Greed motivates them to earn more than others, so they get seduced by the promises of extraordinary returns, invest and fail.

He said that the wisest thing to do is to research how banks make money and do as they do, because whereas around 95% of businesses fail, 95% of banks thrive. I couldn’t find US bank statistics today (if you do please share!), but here’s some information about how businesses are doing according to SBA (Small Business Association):

The SBA states that only 30% of new businesses fail during the first two years of being open, 50% during the first five years and 66% during the first 10.

Source

(I made it past ten years – I’m in my eleventh year of being self employed – yey!)

The author lived at the time of farmer sons moving to the big city to get wealthy. So farmer sons would leave their parents with the hopes that they will succeed as tradesmen usually. And most totally failed.

So the author explains that it’s much more secure to live on your own land than to leave it and hope to get wealthy in a city. He actually contacted banks to check what happened to people who left farms to strike it rich in cities. Most died poor, took their own lives, or their lives were ended because of alcoholism.

Though now farmers are hugely underpaid, there are ways to greatly profit from having your own land today also, like transforming a farm into a farm-stay business or something like the successful venture of Isabella Tree. Farmers don’t need to keep being victimized by corporations – they can carve out their own niches.

Increasing money through your work

The author goes into great detail explaining how people from different work spheres can increase their income now. Some of the advice is applicable to every work sphere, like the following one.

He explains how essential it is to do your best and to be kind to everyone (staff and customers) at work, because this will increase your pay, whether you’re employed or whether you have your own business.

For example, if you’re employed, even if you don’t like the kind of work that you do, if you do your best and be really kind to customers, either the employer will notice that you’re doing the work of two people and increase your salary, or you will be offered a better-paying job by someone who sees how great you are. The Universe is not blind – It rewards everyone fairly.

Of course, if your soul is totally repulsed by what you do, even Eckhart Tolle advises to leave that place as you’re not supposed to be there. But it’s best to see your work as a stepping stone to something better and not to make an enemy out of it. When through kindness and efficiency you outgrow your position, be sure that it will change.

Treat your existing customers well

If you have your own business, through being honest, excellent at what you do and kind to others you will always get repeated business.

I can attest to this. My Life Assessment clients praise my work, tell about it to their friends, and order additional charts for their family members. I recently got a Paypal notification that I’m one of a few business owners who gets a large percentage of money from repeated purchases.

Even today it’s so rare to find businesses taking their customers seriously. It’s very common for businesses to take their existing customers for granted and to focus all their resources on gaining new ones.

That’s such a big mistake. I do the opposite – I appreciate my existing clients and in return I get their love, respect and additional purchases.

That’s what the author advises to do – to treat your customers totally honestly, to provide the best service possible, and to be kind to them. And then they will talk about you, recommend you to their friends and make repeated purchases.

Finally…

Again, the name of this book is How To Make Money, And How To Keep It and it was written by Thomas A. Davies. The book is available on the linked website for free.

Thank you for this great article. I am building new habits in money management.